Shops in Germany, 2006. (Photography by Dominik Schwind, CC BY-SA 2.0)

A surprising way to jump-start a sluggish economy.

In December 1991, as the US economy was still struggling out of an eight-month recession, a University of Michigan economist published an op-ed in the New York Times advocating an unconventional strategy for stimulating the economy—an announcement that after one year, a national consumption tax would be added to states’ sales taxes. Consumer spending would get a boost from Americans rushing to make big-ticket purchases before the new tax took effect, he reasoned, and it wouldn’t be a drain on the federal budget like tax cuts or deficit spending. Over the next 25 years other economists published similar proposals featuring an announced future tax increase, though these were theoretical exercises without real-world data.

A few years after the United States recovered from the Great Recession, Chicago Booth assistant professor Michael Weber was exploring unconventional fiscal policies like these. He realized he would be able to take a preannounced sales tax hike beyond a thought experiment—such a tax had already been levied, and he had been there to witness its effects.

Weber was an undergraduate in his native Germany in November 2005 when the government announced that, to bring Germany into compliance with European Union regulations, it would raise the country’s value added tax (essentially a sales tax ) by 3 percentage points, effective January 2007.

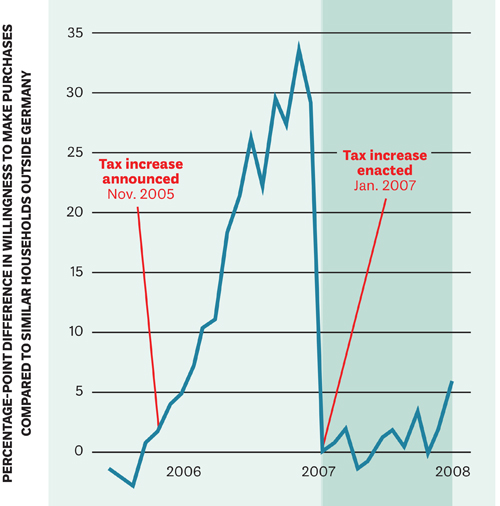

Using data on consumer attitudes and spending habits from a marketing research firm, Weber and colleagues from the University of California, Berkeley, and the Karlsruhe Institute of Technology analyzed 2,000 German households’ willingness to purchase furniture, electronics, cars, jewelry, and other high-price durable goods from 2000 to 2013. The researchers then compared the Germans’ propensity to spend with that of similar households in EU countries without looming VAT increases.

The data showed a sharp spike in the German households’ proclivity to buy these big-ticket items in the 14 months between the tax hike announcement and the effective date; in November 2006 Germans were 34 percent more willing to buy costly durable goods compared with the other Europeans and with their 2005 baseline levels. Weber and his colleagues calculated that the increased motivation to spend resulted in a 10.3 percent uptick in actual durable goods consumption in Germany over those 14 months. After the higher tax went into effect, Germans’ appetite for big purchases dropped, but only to preannouncement levels.

Weber even personally saw the impending tax increase spur a consumer into action—he remembers his father purchased a new car a few months before he had planned to in order to avoid paying the higher tax.

Like other economists, Weber and his coresearchers advocate making the policy budget neutral by pairing an announced sales tax increase with income tax cuts, or possibly direct cash payments, for lower-income households to offset the regressive nature of the policy and give more people more buying power.

The study’s findings “might be a little bit behind” for the United States right now, says Weber, as the American economy is on an upswing. But the policy could be beneficial to a country like Italy, which has experienced three decades of negative growth and has high budget deficits. And it wouldn’t be a bad idea to “keep our gunpowder dry,” he says, for the next time the US economy needs a boost.