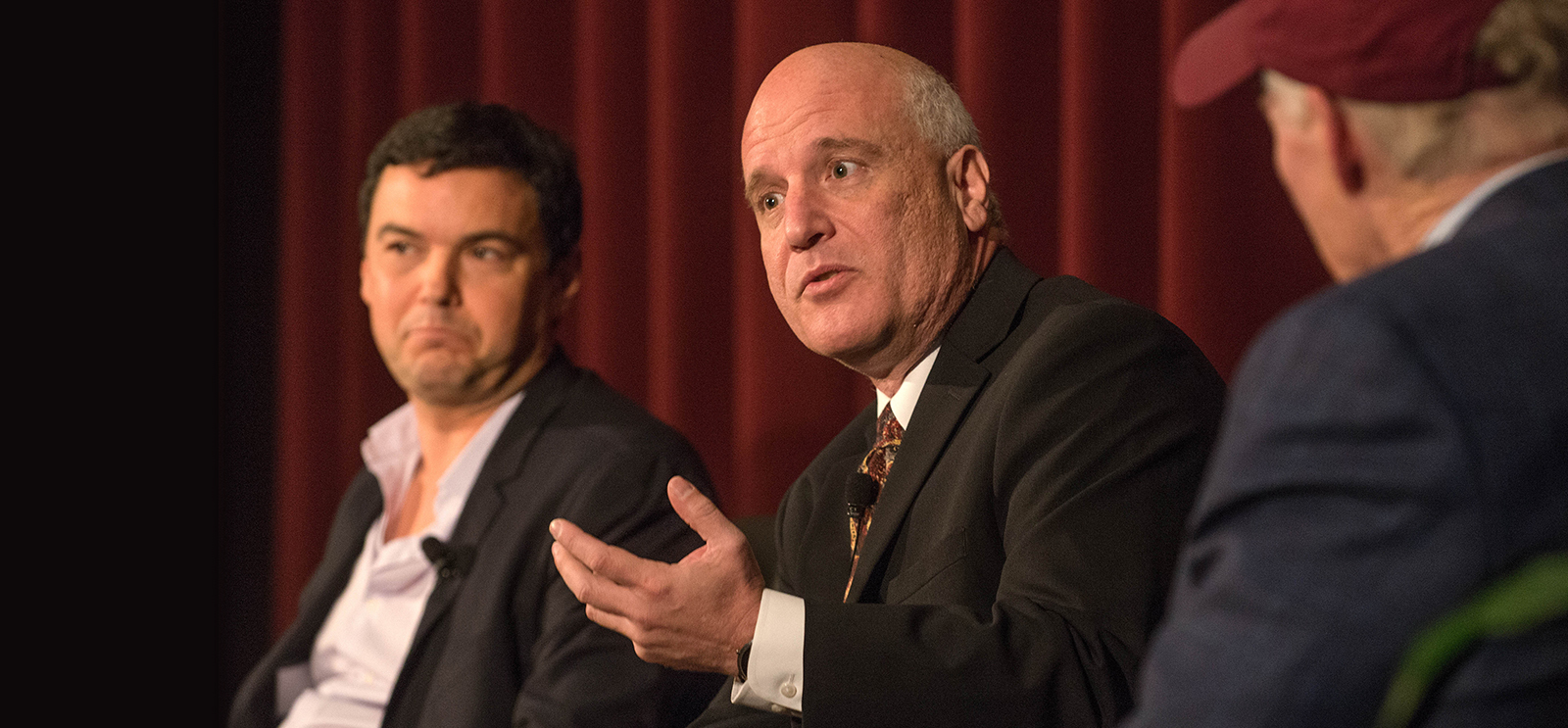

At the panel, Steven N. Durlauf (center) said inequality is “translated” from parents to their children. (Becker Friedman Institute for Economic Research)

Scholars discuss the causes of growing economic inequality in the United States and what to do about it.

There are few issues that are more gripping than the question of inequality in society,” said James J. Heckman, the Henry Schultz Distinguished Service Professor of Economics and Law. The hotly debated topic and notable speakers drew a full-house crowd to Max Palevsky Cinema for “Understanding Inequality and What to Do about It,” a panel discussion that Heckman moderated on November 6, 2015.

The event was organized by the Becker Friedman Institute for Economic Research and the University of Chicago Harris School of Public Policy Studies. The panel featured French scholar Thomas Piketty, professor of economics at the Paris School of Economics, whose Capital in the Twenty-First Century (Harvard University Press, 2013) was a New York Times number one best seller; Steven N. Durlauf, the William F. Vilas Research Professor and Kenneth J. Arrow Professor of Economics at the University of Wisconsin–Madison; and Kevin M. Murphy, PhD’86, the George J. Stigler Distinguished Service Professor of Economics at the University of Chicago Booth School of Business and the Department of Economics.

Each panelist offered his views on the rapid growth of inequality in the United States and which aspects of that growth “are really problematic, which ones may not be so problematic, and what public policies should be,” Heckman said in his introductory remarks. Their opening presentations are edited and adapted here. Heckman then led a discussion between the three of the causes of this growth and potential policy responses. Video of the full event is available at the Becker Friedman Institute website.

That evening Piketty gave a lecture at Chicago Harris, “Reflections about Inequality and Capital in the 21st Century,” followed by a conversation with Kerwin Charles, deputy dean of Chicago Harris and Edwin and Betty L. Bergman Distinguished Service Professor. Video of the lecture and discussion may be viewed at YouTube.

Thomas Piketty: In the United States, the share of income going to the top 10 percent of earners was relatively stable at 30 or 35 percent of total income between 1950 and 1980. In recent decades, we are back to 45 or 50 percent. Why is this so? Very often we talk about globalization, and about China entering the world labor market and putting pressure on the low-skill and medium-skill groups in developed countries. I think this is certainly part of the explanation, but globalization happened not only in the United States but also in Sweden, in Japan, in Germany, in Europe—everywhere—and you don’t have the same rising inequality everywhere.

You need a bit more if you want to explain what we see. Different policies and different institutions have played a role, from education to labor market institutions to progressive taxation to corporate governance.

Unequal access to education is clearly part, possibly a very big part, of the explanation for why inequality has increased so much more in the United States than in the rest of the rich world. There’s a gap between the quality of education available for the bottom groups and the top groups, which is arguably higher than in Europe or Japan. This is possibly the main explanation. But there are evolutions, both at the bottom and the top of the distribution, that are difficult to explain just with education.

At the bottom, the decline of unions and [lagging changes to] the minimum wage have probably played an important role. At the top of the distribution, the rise in very top managerial compensation that you see in the United States is difficult to explain simply in terms of education or productivity—or at least I couldn’t find evidence for it in the data. It’s not just unequal access to education, it’s also the pay-setting process, and to some extent the corporate [governance] system has become more favorable to top managers. Possibly also the incentives for very top managers to put the right people in the right compensation committee have been increased by the huge decline in tax progressivity at the top that has occurred in this country—much more than in the rest of the developed world.

Inequality is a complicated story. The story involves contradictory mechanisms. There are powerful forces that can lead to a reduction of inequality, but there are also forces that can lead to rising inequality for reasons that are difficult to justify.

Let me conclude with new data that wasn’t included in the book that I found very striking. If your parents are in the bottom 10 percent of the distribution you have a 20 percent probability to be in college at age 20 right now in this country. If your parents are in the top 10 percent you have a 90 percent probability. And of course [children of top earners] don’t go to the same university as the people at the bottom.

So I think the gap between the official discourse in terms of meritocracy, equal opportunity, and what’s really going on is just incredibly large. And I think the imagination of the elites to justify inequality and to have discourse about equal opportunity has no limit.

Steven Durlauf: Rather than focus on very broad theories of inequality, income distribution, and dynamics, I want to focus specifically on the disadvantaged within the United States. My view is that inequality, frankly, is too big a phenomenon for any small, low dimensional theory to speak much about. When we talk about the 1 percent, that’s a very different thing than talking about the state of inner cities in the United States.

I want to start off by telling you about three pictures that you may have seen, which are very popular not only in academia but in public policy discussions now. And then I want to link them together with some observations on certain phenomena I think are important in understanding the disadvantaged in the 21st century.

The first figure [developed by James Heckman] some people call the Heckman curve. It’s the observation that if one looks at the rates of return on public investment in children and adolescents there’s a significant decline in rates of return between investments at the age of 3 and at the age of 17.

The curve itself is a nice observation and a useful summary. But what I think is important are the mechanisms that underlie it, and there are two things I want to emphasize. First, the work in early childhood development has been instrumental in creating a synthesis between psychology and economics that is extremely fruitful: the recognition and development of a vision that social and emotional skills are part and parcel of what creates economic success as well as a flourishing life.

I also want to emphasize that this work moves beyond income. In thinking about the consequences of rich early childhood investment, or stable families and the like, it’s not just a matter of asking questions about wages, or even employment. It’s asking about interactions with the criminal justice system, with the stability of families, and personal relationships as an adult. I think that 21st-century inequality demands that we move beyond the conventional measures of income to thinking about notions of capabilities, or what it means to have a flourishing life.

The second figure, which is quite popular, is due to Raj Chetty, Emmanuel Saez, Nathan Hendren, and Patrick Kline. It is a picture of the United States that shows very differing degrees of intergeneration mobility if one looks at relatively small geographic units. Here I’m giving pride of place to the idea that residential neighborhoods and schools are social units that influence individuals.

Ideas in sociology—be they to do with how identities are socially determined; how individuals are influenced by peers, role models, and the like; how aspirations are formed—all of these are being brought to bear in trying to understand how exposure to poverty and disadvantage has long-term consequences. This sociological economics recognizes that human beings are very much influenced by this sequence of interactions they have at a social level.

The third figure is something called the Great Gatsby curve. It shows that those economies that have relatively low levels of cross-sectional inequality also have high [intergenerational] social mobility. This was identified by Miles Corak originally. There’s a very important suggestion here that at a point in time when more inequality exists, somehow it translates into reduced mobility. That in some sense is the strongest attack one might make on the conventional notion of meritocracy, at least in the American case.

The way that I think about these questions together is, roughly speaking, a memberships theory of inequality. What I mean is that individuals throughout their life courses are members of different social groups. The most important one is obviously the family. Whatever inequality is across parents, that is going to be translated into inequality across offspring.

Other sets of memberships are clearly salient as well. One example would be residential neighborhoods. Another would be schools. Another would be higher education. Yet another example would be firms. It’s a very different world that is driven by Microsoft versus the Ford Motor Company in terms of interactions of [workers of] different skill types.

So if we want to understand inequality, one of the many perspectives is to recognize that individuals are influenced throughout their life course by the groups that they are members of and they interact with. The key mechanism in understanding persistent inequality is segregation: assortative mating of highly educated parents, economic segregation, racial segregation of school districts, increasing segregation by income level or by high school achievement across colleges. All of these become mechanisms that translate initial inequalities into persistent inequalities both within the life course and across generations.

What sorts of policies are necessary to break disadvantage? I put particular emphasis on policies that achieve various forms of partial integration. I’m not a madman who wants to interfere with the marriage process. On the other hand, policies that speak to the potential for altering who interacts with who, be they affirmative action, the location of public housing, voucher systems, the drawing of school district zoning, all of them are in my judgment where the currency of egalitarian justice—G. A. Cohen’s term—still lies today.

Kevin Murphy: I’m going to deviate a little bit from what’s happened so far. But it’s important to focus back on some very basic economics. I’m going to focus mostly on labor, because at least within the United States I think the most important changes we’ve seen over time are in the relative returns to low-skilled and high-skilled labor. Changes over time in the difference in wages between workers who have graduated from college and those who stop at high school are striking. Today that difference is somewhere between double and triple, depending on how you measure it, what it was in 1980. That’s an enormous increase in the income gap.

The goal of economic analysis is to understand where that change came from. I applaud Thomas [Piketty] for talking about long-term changes in his book. The same things that have been driving the economy for decades are going on today. If you think about it, the links between inequality and another very important phenomenon, which I’ll call economic growth, are key to understanding both. So I’m going to step back a second and say, what accounts for growth? Where does economic growth come from?

Economists have worked on this for a long time, and we can think about economic growth as coming from three primary places. One, we get better technology over time. We learn how to do things that we couldn’t do before. In response to those new technologies, we invested in physical capital to utilize and implement those new technologies. We also invested heavily in human capital, increasing the education and other skills of our workforce.

If you follow the course of the 20th century and into the 21st century, the rates of increase in technology, physical capital, and human capital are really astounding.

So we get more growth and more technology, and we need the human capital to both produce technology and implement it. Think about a modern automobile plant where we now have robots replacing workers manually putting parts together to build the car. We needed the technology to develop the robots. We needed to invest in the physical capital to improve the plant. And we needed the human capital to design, build, and maintain those robots, and far fewer low-skilled workers.

While technology, investments in physical capital, and investments in human capital work in concert to increase output over time, they work in opposite directions on inequality. Better technology and more physical capital tend to create opportunities for new skilled worker activities while replacing the activities traditionally performed by less skilled workers. Increased investment in human capital increases the supply of skilled workers and reduces the supply of low skilled workers.

So what happens to inequality in many dimensions, particularly across education, is a tug-of-war with growing technology and physical capital on the one hand (on the demand side of the model) and growth in human capital (on the supply side). When demand grows faster than supply, prices (wages, the return to human capital) rise. When supply grows faster than demand, the return to human capital falls.

The theory does an amazing job of explaining significant components of what we’ve seen over decades. Since about 1980 in the United States, the supply of skilled human capital hasn’t grown as fast as demand. Not surprisingly, from the point of view of economics, inequality has risen, and risen dramatically.

If you don’t produce enough skilled workers over time, the wages of skilled workers go up relative to wages of unskilled workers. Well, the forces of economics don’t stop operating. Those skilled workers have an incentive to then supply more skill to the marketplace. They invest more in themselves; they work harder. Those supply responses exacerbate measured inequality. You get the opposite dynamic going on at the bottom of the distribution: wages fall, they’re working less. They invest less in their own human capital. That creates a widening of inequality.

As Steve Durlauf emphasized, we don’t want to focus entirely on income. Human capital is, again, a big part of the story. And the big difference between human capital and physical capital is that you take it home with you at night. It affects many things: your skill at raising your children, your skill at taking care of your own health, your skill at running your financial life, how good you are in dealing with friends, family, and the like. So the human capital shortfall is really quite critical for many outcomes, not just income.

Why do we have such a human capital shortfall? I would agree, we have a lot of people who don’t have very good opportunities to develop human capital. If you fall behind early in life, it’s not impossible to catch up, but it’s extremely difficult. So it’s critical that we enable more people to get the human capital they need. It’s not just education, it’s the “soft” skills too. While people might call them soft, they’re hard in that they’re not so easy to get, and they really matter for success.

You might say, not everybody is going to be able to get more human capital. The saving grace of the economics is, they don’t have to. If some segment of the population does increase their human capital, they would reap the high rates of return that we see in the marketplace today. But the remaining low-skilled workers would also benefit, because there would be less competing supply of low-skilled workers. That would benefit them in terms of higher compensation and incentivize them to be more attached to the labor force, to work more.

So the answer, I think, has to focus on human capital. If the growth in inequality is telling us anything, it is telling us that there’s a shortage of skilled labor, and we should do what we can to increase it and create more opportunity for people at the bottom.