Harold Pollack. (University of Chicago Crime Lab)

The New Year is under way, but it’s never too late to add a few good resolutions.

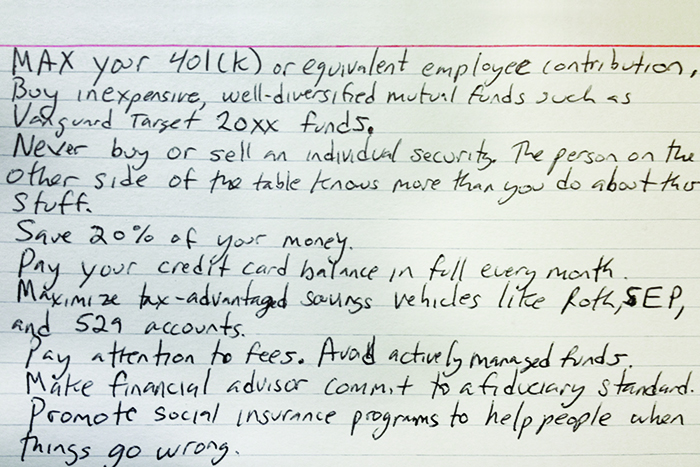

It started out as a figure of speech. Last spring, Harold Pollack, the Helen Ross professor at the School of Social Service Administration, was interviewing Helaine Olen—the author of Pound Foolish: Exposing the Dark Side of the Personal Finance Industry (Portfolio Hardcover, 2012)—for The Reality-Based Community, a group blog he contributes to. He said he thought that the correct basic financial advice for most people would fit on an index card.

We’d like to see that card, wrote in some of his readers. “So I took one of my daughter’s index cards for school, took about two minutes, wrote these things down, took an iPhone pic, and put it up.”

In September Pollack’s hand scribbled advice made an appearance on another blog he writes for, the Washington Post’s Wonkblog, and soon it was whipping around the web, blogged, tweeted, Tumblred, and Facebooked. “There’s nothing I wrote there that someone knowledgeable about finance doesn’t already know,” Pollack says. “But somehow people found it valuable. The fact that I have crappy handwriting seems to increase its appeal.”

Most of the push back he’s received centers on two points. The directive to save 20 percent of your earnings sounds to some “like telling a basketball player she should be taller,” he says, granting that it’s not practical for everyone. He’s also heard dissent about the support for social insurance recommended in his last tip, but he stands by the advice.

The guidelines were easy to enumerate, Pollack says; the hard part is executing them. But after four or five years of doing so, in his experience, “you start to say, my life is becoming a little different.” In the season of resolution making, we share his fitting wisdom.