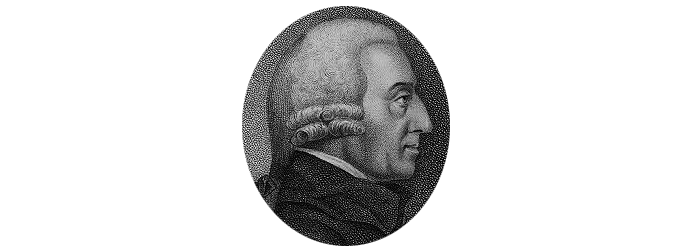

Economist George J. Stigler, PhD’38, revolutionized his field by arguing that regulation may have the unforeseen consequence of hindering competition. (Special Collections Research Center, The University of Chicago Library)

In the age of technology giants, does capitalism need protection from big business? Luigi Zingales thinks so.

One of the busiest corners of the globe at the opening of the year 1872 was a strip of Northwestern Pennsylvania, not over fifty miles long,” journalist Ida Tarbell wrote in 1902. In the span of just 12 years, those once quiet Pennsylvania hills were overrun with hardy young entrepreneurs seeking to make their fortunes from a new product: petroleum. But the days of bustling competition did not last.

“At the very heyday of this confidence,” Tarbell went on, “a big hand reached out from nobody knew where, to steal their conquest and throttle their future.”

The throttling hand was that of John D. Rockefeller. By 1880 his Standard Oil Company controlled about 90 percent of the oil produced in the United States, including its transport, refining, and marketing. Rockefeller pioneered market domination by undercutting prices across all areas of the oil business and buying up his competitors.

For a cohort of eight journalists on campus at the University of Chicago Booth School of Business this past spring, Tarbell’s two-year 19-article exposé on Standard Oil—widely considered to be the birth of investigative journalism—served as both inspiration and how-to guide.

Credited with exposing the deleterious effects of monopolies on society, as well as inspiring government efforts to counter them, Tarbell’s muckraking series “created the political demand for intervention,” Chicago Booth economist Luigi Zingales explained in a recent episode of his podcast Capitalisn’t. In 1911 the Supreme Court ordered the dissolution of Standard Oil into 34 individual companies. (Rockefeller, who referred to Tarbell as “Miss Tar Barrel,” became the nation’s first billionaire and spent the later years of his life giving away much of his fortune, including funds to found the University of Chicago.)

Journalists and business school professors may seem like strange bedfellows, but not to Zingales, the faculty director of the George J. Stigler Center for the Study of the Economy and the State. In 2017 he launched the Stigler Center Journalists in Residence program. For the reporters who participate, it’s a taste of the business school experience and a crash course in economic theory: they audit classes, meet scholars, and attend special events.

Why invest in the next generation of muckraking? Because, in Zingales’s view, capitalism depends on it. He believes investigative journalism is a major reason why American capitalism has historically been so successful compared to the “crony capitalist” systems that prevail elsewhere. Take his native Italy, where, he has argued, personal connections—not merit or competition—determine who wins in the marketplace.

The guiding idea behind the residency is that journalists in the trenches—filing pieces on the daily and weekly happenings of the business world and exposing special interests that aim to subvert markets for their own gain—help create a demand to keep markets free.

“Inquisitive, daring and influential media outlets willing to take a strong stand against economic power are essential in a competitive capitalist society,” Zingales wrote in the Financial Times in 2015. “They are our defense against crony capitalism. When the media outlets in any country fail to challenge power, not only are they not part of the solution, they become part of the problem.”

The problem, as Tarbell’s oil capitalists experienced and as the Stigler Center recognizes, is that capitalism itself is so fragile.

Adam Smith’s invisible hand and the free-market laissez-faire approach so famously espoused by Chicago economists can easily be shackled by special interests (See “Pro-market or pro-business?” below.). These include price-cutting monopolies like Rockefeller’s Standard Oil; competition-shy incumbents aiming to deter new market entrants; and rent-seeking corporations that look to the government for an advantage in the marketplace via subsidies or regulatory capture—that is, when laws increase the market advantage for the very firms meant to be regulated.

It was UChicago Nobel Prize–winning economist George J. Stigler, PhD’38, the eponymous founder of the Center for the Study of the Economy and the State, who first questioned the impact of regulation on competition and who in 1971 put forward the idea that industry “acquires” regulation for its benefit. His two-part hypothesis: one, industries will wield whatever political power they have to prevent new competitors from entering the market, and two, regulations will be written to slow those new entrants’ growth.

Before Stigler, regulation had been studied entirely from a content perspective—in other words, how the rules were written to prevent market failure and protect consumers from unfairly high prices. Not questioned was the assumption that regulation itself, particularly of natural monopolies such as public utilities, was necessary. So Stigler and his coauthor Claire Friedland, AM’55, took up the study of electricity regulation, aiming to understand the actual outcomes of such controls, as opposed to the intentions. Did regulation keep prices for consumers down? By comparing areas with varying degrees of electricity oversight from the early 1900s to 1960, Stigler found that the price difference was negligible, casting doubt on the need for regulation at all.

The finding shocked economists. “I can’t tell you how important it was,” says Sam Peltzman, PhD’65, a graduate student of Stigler’s who took over directing the center after Stigler’s death in 1991. “What happened next was a period of great ferment.”

Over the subsequent decades, economists followed Stigler’s lead in examining the real-world effects of regulation and stopped taking for granted that regulation accomplishes what it intends. Stigler’s 1982 Nobel citation states that his work “resulted in fundamental testing of the forces, purposes and effects” of legislation.

For his part, Peltzman, the Ralph and Dorothy Keller Distinguished Service Professor Emeritus of Economics, carried on Stigler’s work by digging into the more nuanced outcomes of regulation. He put forward a model for analyzing the trade-offs and unintended consequences of such rules. Peltzman argued that even the most beneficial of regulations still have trade-offs, because people tend to change their behavior in ways that counteract the regulation’s aim. The most famous example of what is sometimes called the Peltzman effect is car safety regulations. In a 1975 paper he argued that, although safety features including seat belts saved lives, a portion of the benefit was offset by increases in reckless driving and nondriver deaths.

Later, in a 1983 paper, Nobelist Gary Becker, AM’53, PhD’55, offered his model of regulation, in which he noted that interest groups are not a monolithic bloc but consist of competing interests. As he explained in the Wall Street Journal in 2010, “Once you’ve got a piece of legislation in place, interest groups grow up around it.”

Overall, Stigler set in motion an understanding for which Chicago economics has become known: that the outcomes of regulation and government intervention, such as antitrust litigation, are complicated, to say the least—and, at worst, can end up hurting competition and hampering free markets.

This brings us back to the Stigler Center today, where its current director, Zingales, is in the surprising position of arguing that the pendulum against antitrust and government regulation has swung too far.

“My claim is that part of the change in attitude is due to a change in surroundings,” he says in his office the day before convocation, when he will speak to 2019 graduates about their political power as consumers. “The world today is completely different from the world in the 1970s.”

A little more than a century after Progressive Era figures like Tarbell and Senator John Sherman intervened against Rockefeller, the economy has cycled through the Great Depression, the increasing regulatory environment of the 1950s and ’60s that Stigler studied, and the economic contraction of the 1970s, which, “as a result, in part, of the triumph of the ideas of the Chicago school,” Zingales says, was followed by a reduction in regulation and an era of innovation and economic expansion, lasting until the 2008–09 meltdown of the financial sector.

Now the Stigler Center has cast its gaze on Silicon Valley and its digital titans, Amazon, Apple, Facebook, and Google. This fall, wrapping up a large-scale effort to examine the current shape of economic concentration and its effects in the United States, the center issued its assessment: there is little evidence the market will, or can, rein in these companies’ increasingly unchecked power.

The finding drew from the work of 30 experts from across the country; representing the fields of business, economics, law, and political science, they spent a year researching and debating whether monopoly has reached a worrisome level. The ultimate question was what to do about, to use Tarbell’s phrase, the “big hand” of tech giants in the marketplace.

One surprising and much-debated conclusion was to create a digital authority to regulate the industry. In May Yale economist Fiona Scott Morton, who led the Stigler Center group that analyzed the market structure of the digital platforms, quietly delivered the recommendation to the US Senate as part of hearings on digital advertising and competition policy. Zingales spent the summer getting traction on the idea of a digital authority. In July Fortune magazine ran a feature on the center’s proposal to tailor regulations to limit big tech’s power, and in September the New York Times business section trumpeted, “Chicago School Professor Fights ‘Chicago School’ Beliefs that Abet Big Tech.”

Peltzman, however, isn’t convinced that a new regulatory authority will work. “It’s just not the right tool to address the nonexistent problems,” he says. “I’m skeptical. Having said that, it’s certainly relevant to have a discussion. I hope we have a discussion instead of a crusade.”

In an episode of the podcast Capitalisn’t, Zingales faced similar criticism from George Mason University economist Tyler Cowen, a panelist at the center’s conference on digital platforms and the author of Big Business: A Love Letter to an American Anti-Hero (St. Martin’s, 2019).

“I would stress the negative secondary consequences of regulation,” Cowen warns on the podcast. Setting up a regulatory agency, he argues, “is a very dangerous step. It’s an entry barrier. It’s an opportunity for rent seeking. It will limit innovation.”

As the economists, law scholars, and political scientists debate, one thing is certain: the Stigler Center’s journalists have been all ears. The purpose of the residency program, after all, is to educate the journalists. How they use what they learn is up to them

All spring Adam Creighton was on fire with the ideas he was encountering at UChicago. The economics editor for the Australian and a 2019 Stigler Center journalist in residence, Creighton filed stories and columns that bore the fingerprints of the classes he was taking and scholars he’d met during his 12 weeks in Hyde Park. In one piece he argued that patents create “artificial monopolies”; in another, a critique of Australia’s retirement savings system, he cited UChicago’s own Eugene Fama, MBA’63, PhD’69, and Richard Thaler.

Meanwhile, in Bengaluru, the Silicon Valley of India, the Economic Times’s Megha Mandavia, a 2018 Stigler resident journalist, was helping her readers make sense of unfolding efforts to tax Facebook and Google. The move would help the Indian government reap some of the vast profits the companies generate from citizens via advertising and data monetization.

In the United States, from the Election 2020 desk at the Wall Street Journal, another 2018 Stigler resident journalist, the Pulitzer prize–winning reporter Jacob Schlesinger, published three pieces in June on the many challenges presented to policy makers by Amazon, Apple, Facebook, and Google. The influence and effect of these platforms on markets, he wrote, are particularly challenging to grasp because they don’t fit old models of monopoly that would signal harm to consumers and trigger antitrust action: the combination of higher prices and less choice.

“Free services are good for consumers,” Schlesinger wrote. “Monopolies tend to be bad for them. The big tech platforms have elements of both—a combination that is vexing policy makers around the world as they struggle to figure out how best to police American technology behemoths and their unusual business models.” The outcome, he and colleagues reported in a subsequent piece, is a “mounting backlash” against technology giants “that threatens to raze the four-decade-long Washington consensus to defer to markets in setting boundaries for corporate competition.”

On campus, at the last Friday noontime seminar of the spring 2019 quarter, this year’s journalists gathered for a pizza lunch with Chicago Booth’s Austan Goolsbee, who chaired President Barack Obama’s Council of Economic Advisers and is the Robert P. Gwinn Professor of Economics. After Goolsbee gave a short overview of his research, the questions began. Xinning Liu of the Financial Times asked about the US-China trade war, trying to understand the real-time and potential long-term implications of President Donald Trump’s proposed tariffs.

Other journalists peppered Goolsbee with equally timely questions about the outcomes of a recent Federal Reserve conference, whether a recession is on the horizon, the student debt bubble, the viability of the wealth tax, his thoughts on universal basic income, and his favorite in the 2020 presidential race. Asked what he thought of the idea of a digital authority, Goolsbee wondered aloud how it would work in practice.

After the session, the Australian’s Creighton gave his own take on the proposed digital authority: “It’s not very Stiglerian.”

The comment doesn’t faze Zingales, whose work as he carries on the legacy of Stigler requires him to grapple with what makes an idea “Stiglerian.”

“I think, and I’m sure I’m not alone here, that the contribution of Stigler is great, but mostly to learn what we should not do,” he says later, back in his office. Stigler’s work shouldn’t be used as a justification for sitting back and doing nothing, Zingales argues. “I think that the absence of regulation can be as bad as, and sometimes worse than, bad regulations. … I’m very happy to come to a conclusion, if you convince me, that maybe the intervention is not worth the effort. But starting with the presumption that nothing can be done? That’s the kind of ideological block that I would like to avoid.”

So what does Zingales believe is Stiglerian? It depends—and that was true even for Stigler, he says. He notes that Stigler’s views also evolved to fit the times, citing the economist’s 1952 Fortune magazine article “The Case Against Big Business.” In it Stigler argued for breaking up large corporations when necessary, writing, “This, I would emphasize, is the minimum program, and it is essentially a conservative program.”

Zingales lets the effect of Stigler’s statement sink in.

“Wait a minute,” he says, “what is so conservative about that?”

In 1952 Stigler saw no economies of scale in big business and argued that it was better to break up than to regulate large firms. But those ideas evolved under the influence of another UChicago economist, the late Harold Demsetz, who established that big business tends to be more efficient. Zingales’s point: what’s conservative depends on the evidence and the context—and maybe what’s Stiglerian does too.

“If the world around you changes, you should change your prescriptions,” Zingales says. “If you don’t, it’s called ideology. … I don’t say, whatever Stigler said in 1970, it cannot be changed. That’s religion, not research.”

Sharla A. Paul is a writer and editor in Hyde Park.

Pro-market or pro-business?

A primer on subversive special interests.

In The Wealth of Nations (1776), Adam Smith posited that competition is the essential ingredient that makes a market economy work and that a competitive market system ends up benefiting everyone. Two hundred years later, George J. Stigler, PhD’38, outlined how governmental regulation interferes with the healthy functioning of that system. Now, Stigler Center director Luigi Zingales and others are keeping a watchful eye on how new forms of special interest in business and government can intrude too. Here, according to Zingales and the other editors of the Stigler Center’s blog, ProMarket, are several key ways special interests can subvert capitalism and undermine the public good.

Antitrust Pro-business versus pro-market. “Businessmen like free markets until they get into a market; once they are in it they want to block entry to others,” Zingales explained in 2012. “Pro-marketeers want free markets at all times.”

According to the ProMarket editors, a good way of telling where someone lands on the pro-business–pro-market continuum is their stance on antitrust policy. “Pro-business usually favors incumbents”—established firms—“while pro-market calls for aggressive antitrust enforcement to facilitate competition,” they write.

Corporate governance “The system of formal and informal rules by which a company is governed,” according to the ProMarket editors. “Corporate governance therefore affects and is affected by the degree of cronyism and rent seeking in society.”

Cronyism When who you are or who you know determines who gets a job or a contract, or when a monopoly so dominates a marketplace that efficiency and innovation no longer matter, that’s cronyism at work. Italy practically invented cronyism and nepotism, Zingales claims, beginning when the natural children of Pope Alexander VI were called “nephews” and given plum positions in the Catholic Church. The result is a vicious cycle, with “incompetent nephews and stupid cronies” tending to hire subordinates of equal or lower quality, eroding human capital, causing firms to resort to lobbying when threatened, and systematically harming even successful economies.

Money in politics “The ones who are the best at business these days are the ones who are best at lobbying, not at making gadgets or new ideas,” says Zingales. He has proposed taxing lobbying (“the best way to discourage a behavior is to tax it,” he quips), as well as the powerful tool of “naming and shaming” firms that engage in excessive lobbying.

Regulatory capture In his 2019 convocation speech, Zingales recalled: “George Stigler ... has taught us that regulation tends to be shaped—what we economists refer to as ‘captured’—by the very companies it is supposed to discipline. It increases their power rather than reducing it.”

In his landmark 1971 paper, Stigler outlined the “supply” and “demand” for regulation, proposing that industry “acquires” regulation, and that regulation is “designed and operated” primarily for the benefit of industry. Zingales often gives the example of the Dodd-Frank Act, meant to police the financial services industry following the 2008 crisis, and its Volcker Rule. The regulation is so complicated that it’s nearly impossible to enforce—which, he argues, is why banks wanted it.

Rent seeking Rent seeking is “when one group tries to obtain privileges from the government to secure profits beyond those available under well-functioning markets,” according to ProMarket. Examples include tariffs, subsidies, and the 2007–09 bailouts for “too big to fail” banks.